Skip to content

Debt Information

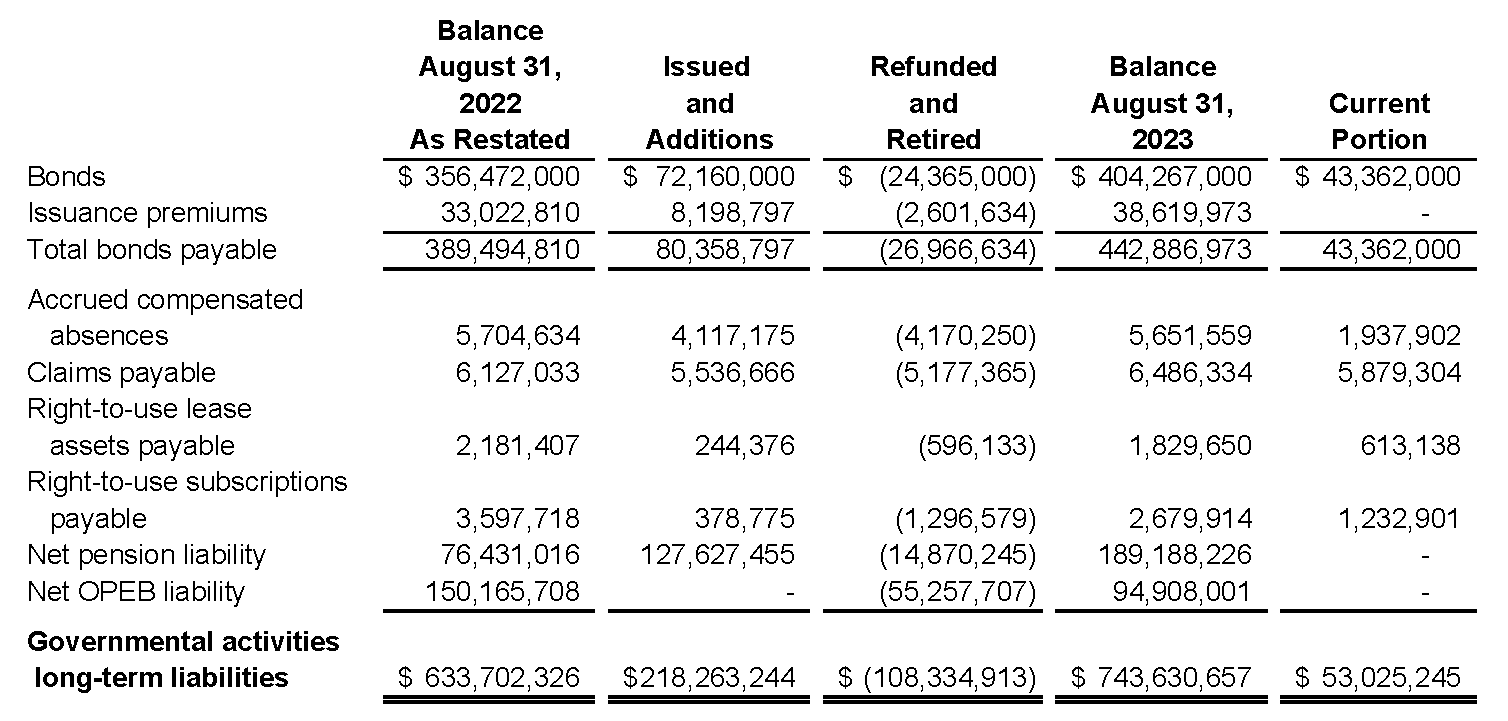

Debt Obligation

The Business and Support Services Department is responsible for preparing financial reports and debt information that promote transparency and accountability.

The information below shows debt obligation as of August 31, 2023.

Debt Information Summary

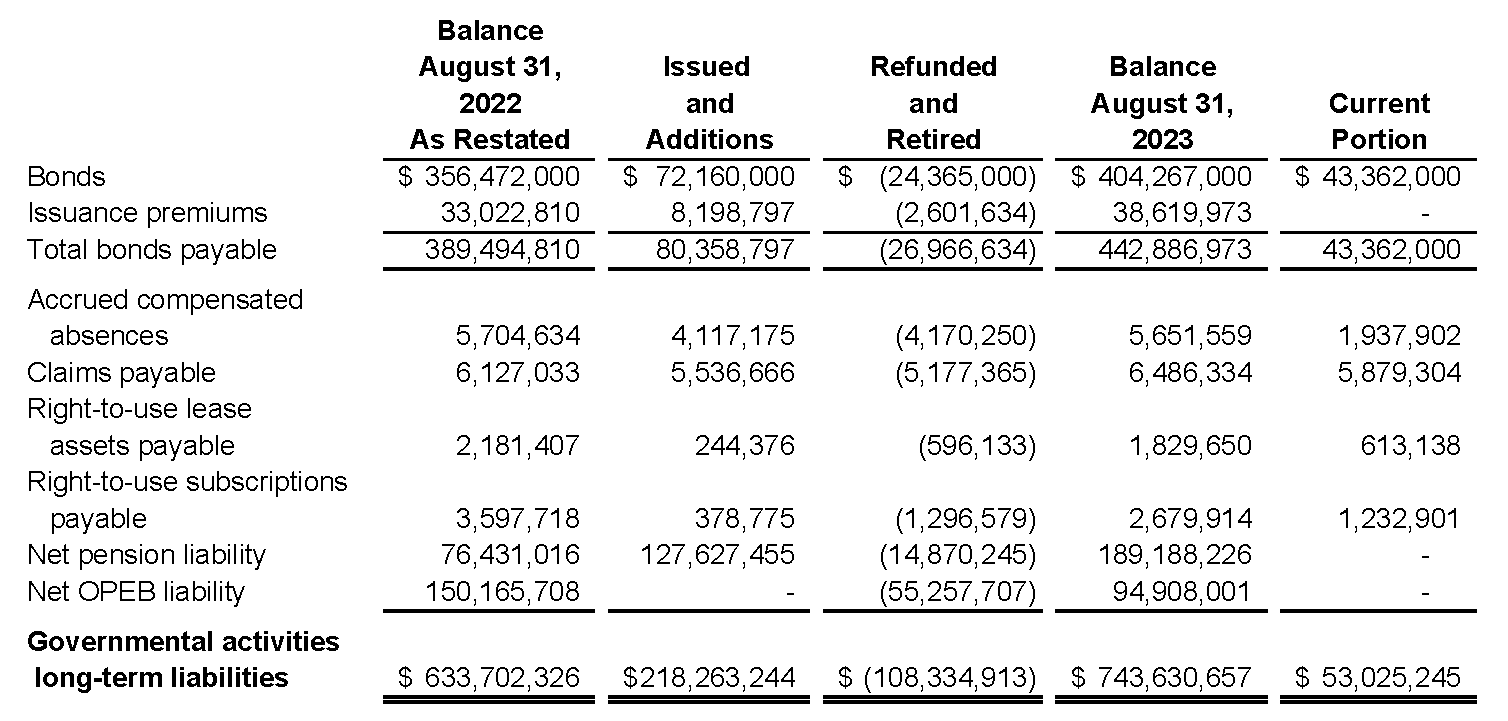

Long-term debt consists of bonds payable, capital leases payable, claims payable, net pension liability, net OPEB liability, and a provision for compensated absence. Bonds are payable solely from future revenues of the Debt Service Fund. The District is in compliance with all significant bond compliance requirements. Internal Service Funds serve the governmental funds. Accordingly, long-term liabilities for them are included as part of the totals for governmental activities. See Note 13 for disclosures regarding claims payable for Health Insurance and Workers' Compensation. Other long-term liabilities are generally liquidated with resources of the General Fund. See Note 14 for additional disclosures regarding compensated absences, Note 11 for defined benefit pension plan, and Note 12 for defined other post-employment benefit plan.

A summary of long-term debt transactions of the District for the year ended August 31, 2023, follows:

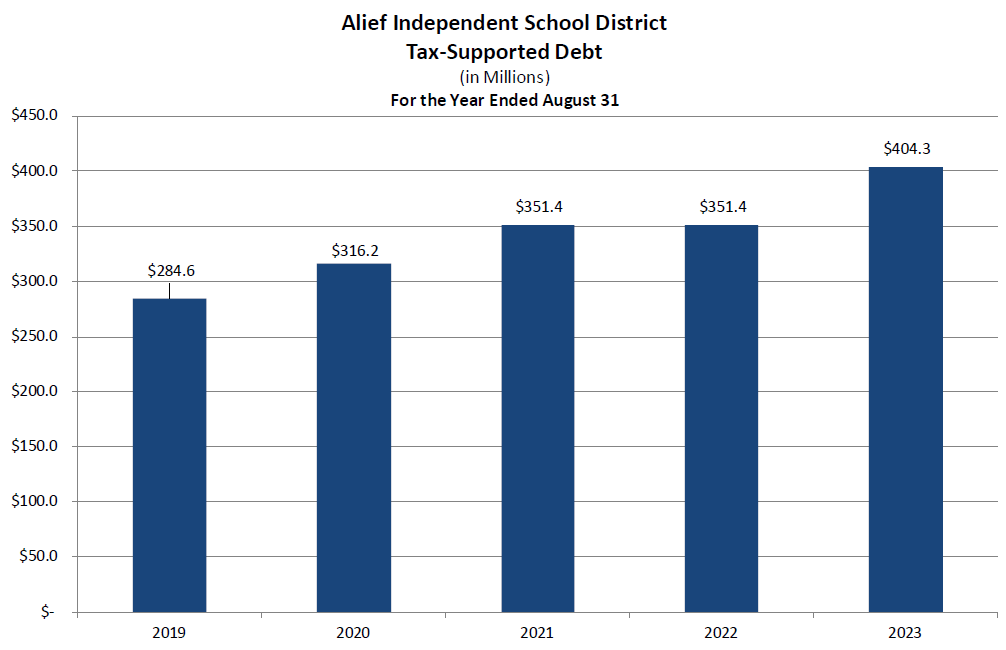

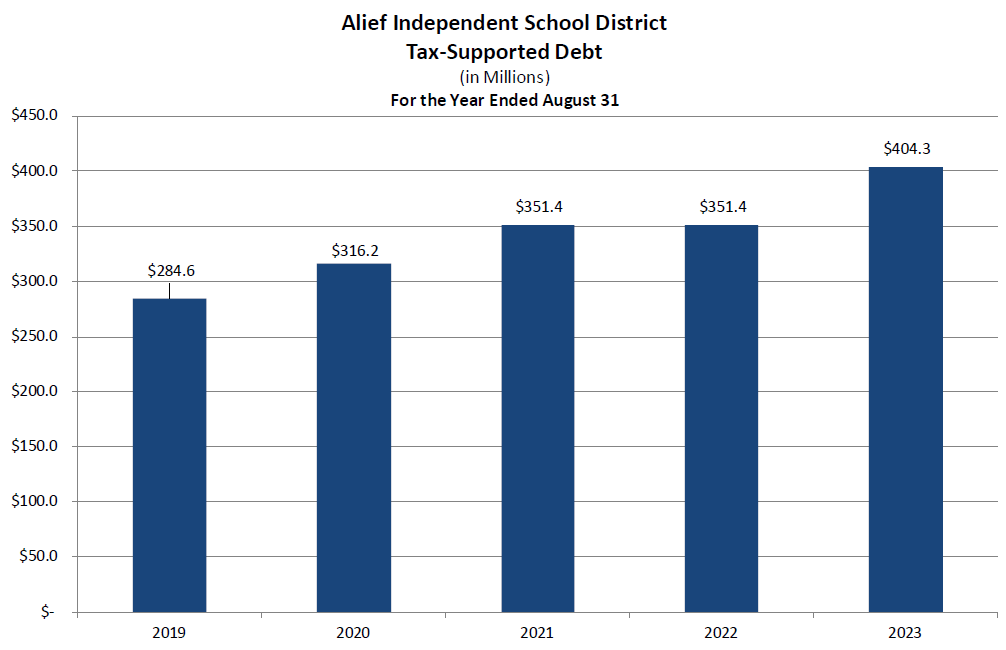

Tax-Supported Debt Trend

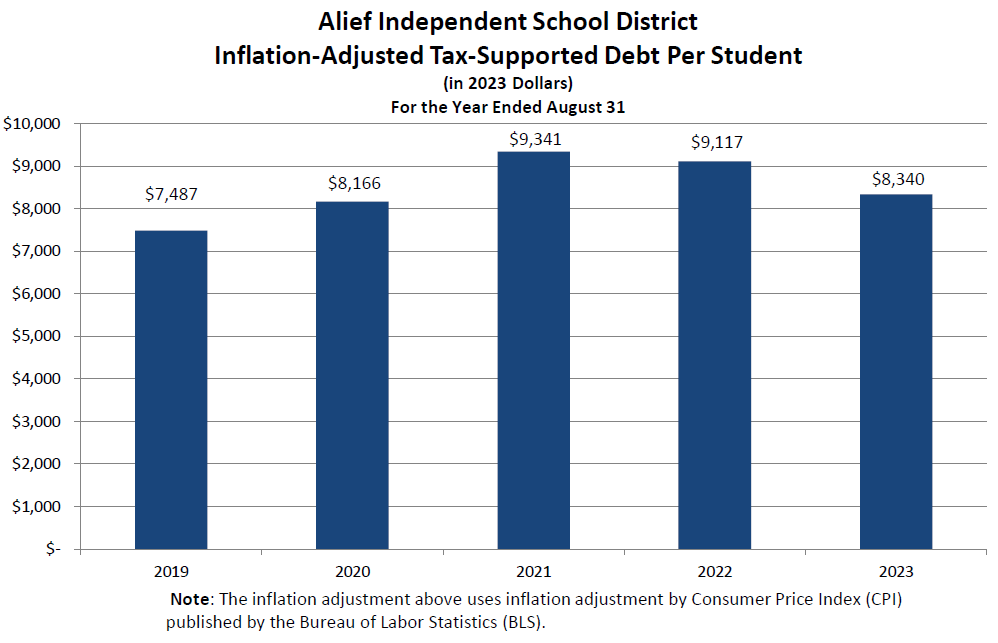

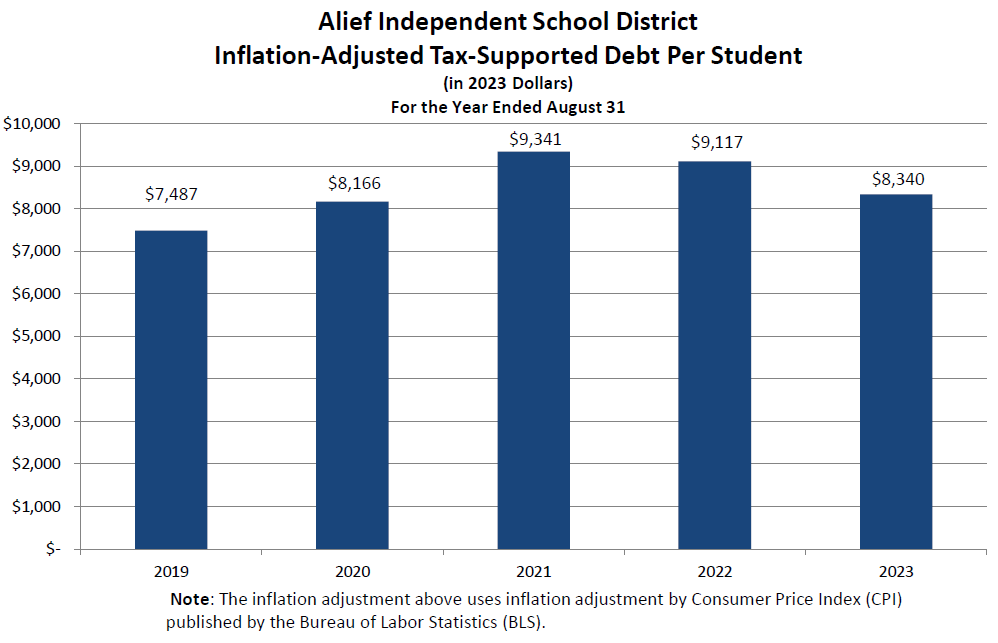

Inflation Adjusted Tax-Supported Debt Per Student Trend

Outstanding Bonds Payable

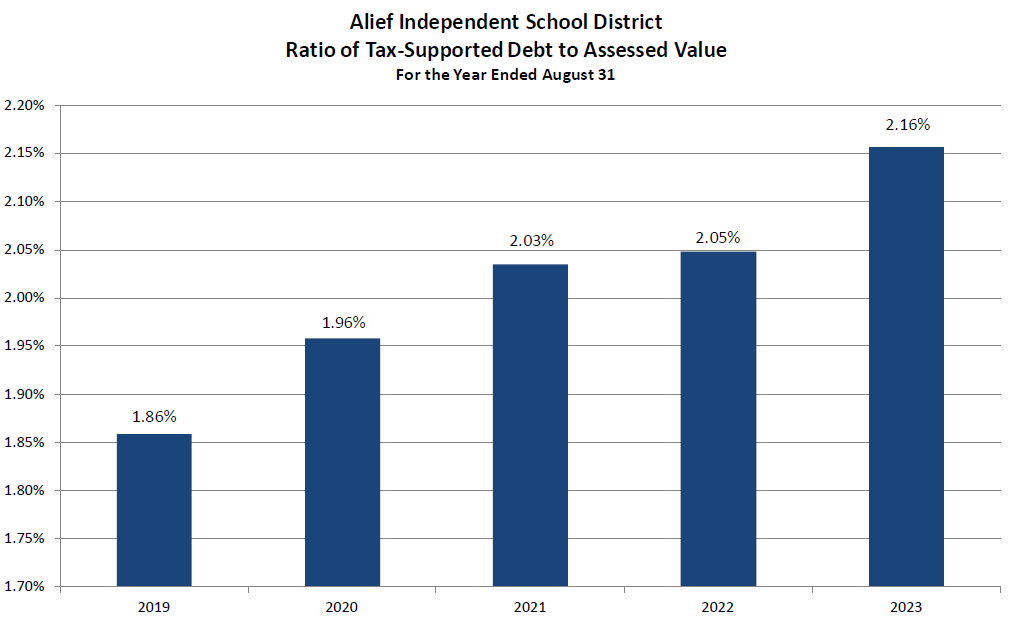

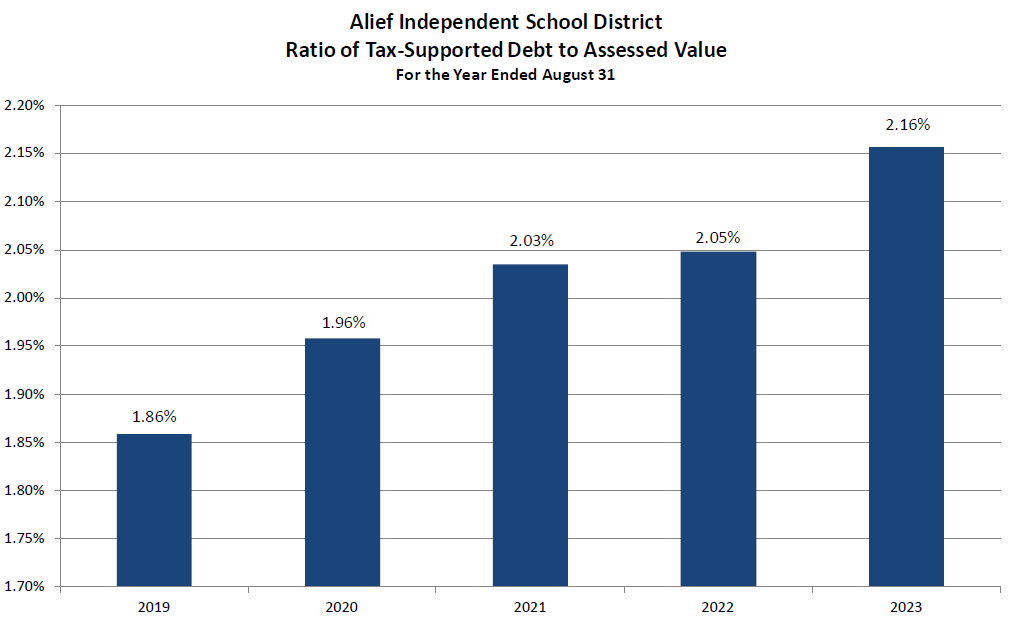

Ratio of Tax-Supported Debt to Assessed Value

Bond Elections

The most recent bond election held by Alief ISD was the 2021 Bond Referendum. Alief ISD has not held any subsequent bond elections.

2021 Bond Referendum

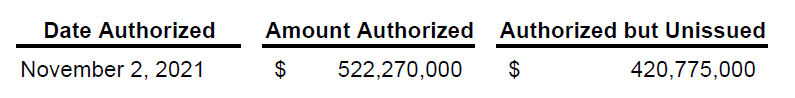

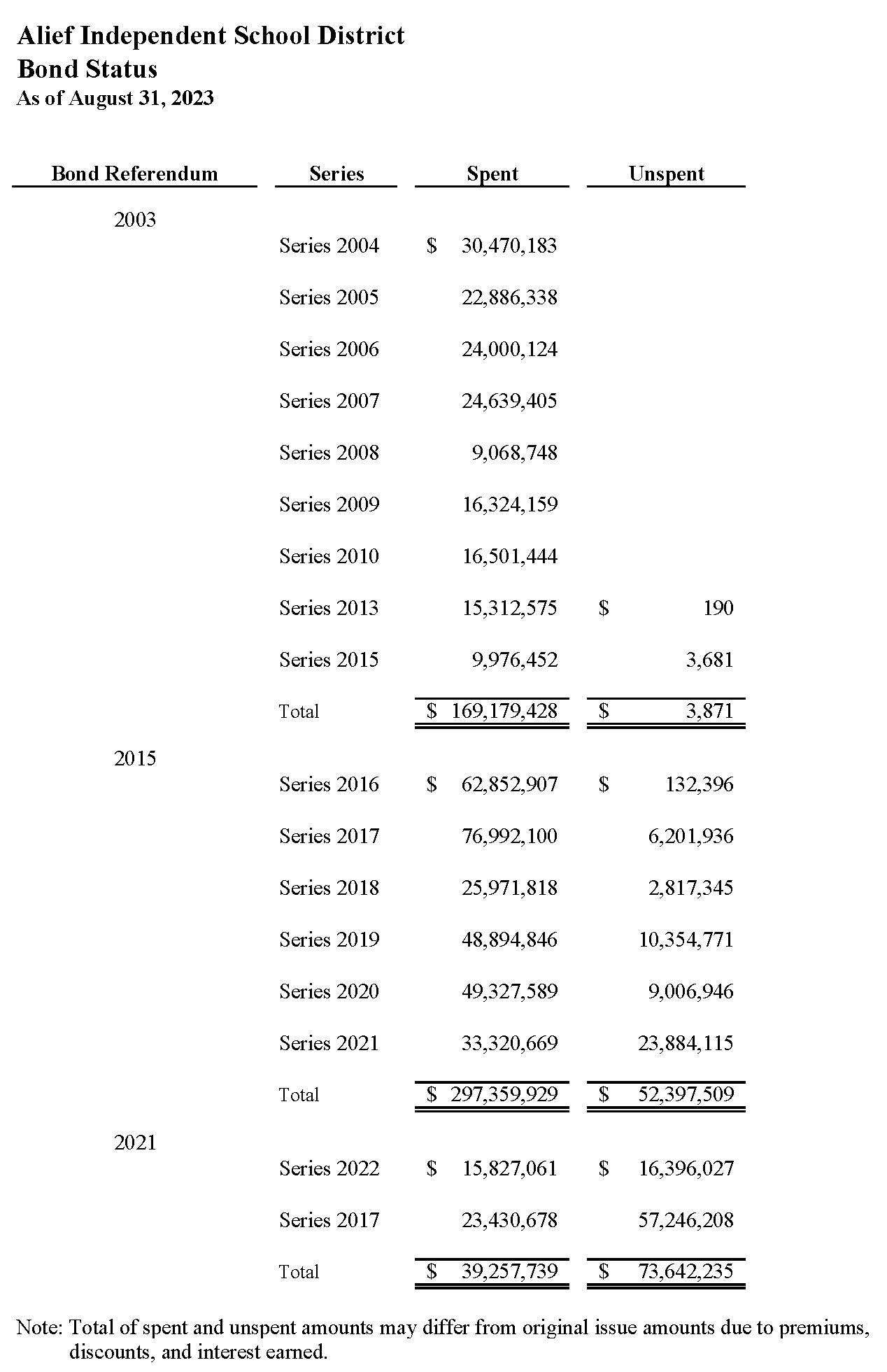

Alief ISD voters approved Proposition A ($482,585,000), Proposition B ($9,095,000), and Proposition D ($30,590,000) of the 2021 bond referendum on November 2, 2021 for a grand total of $522,270,000. The first installment of $31,000,000 was sold on 6/2/2022 and will fund projects such as carpet replacements, classroom additions, school buses, track resurfacing and various other facility assessment projects. The second installment of $79,885,000 was sold on 5/2/2023 and will fund projects such as carpet replacements, classroom additions, school buses, police vehicles, music and art equipment, securing building entries and libraries, tennis court resurfacing, an agriculture science center as well as various other facility assessment projects.

2015 Bond Referendum

Alief ISD voters approved the 2015 bond referendum on May 9, 2015 totaling $341,000,000. The approval rating for the referendum was 72.3 percent as 830 votes were cast for the referendum and 318 votes cast against the referendum. The District has issued the final installment totaling $55,335,000 in June, 2021.

2003 Bond Referendum

On September 20, 2003, an election was held, and the voters authorized bonds of $175,000,000 by a vote of 1,264 for (89%) and 150 against. The proceeds were for two elementary schools, renovations, additions, and maintenance to existing campuses including enclosing classrooms at the elementary schools. The District issued the remaining bonds from this referendum in June, 2021.

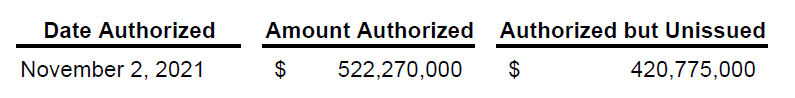

Authorized but Unissued Bonds

As of August 31, 2023 the authorized but unissued balance from the 2021 bond referendum is as follows:

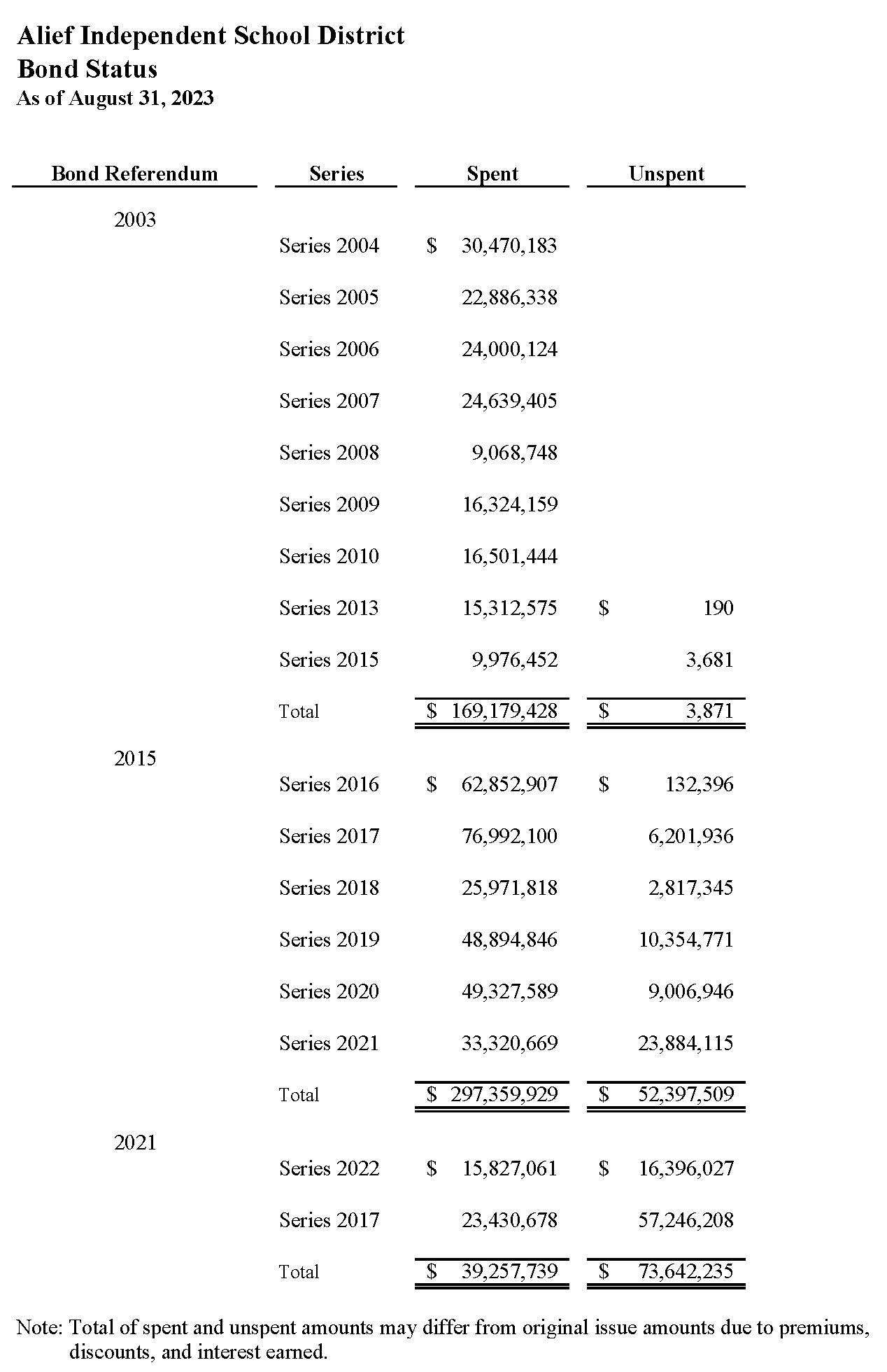

Bond Status

Links and Other Information

Outstanding Tax-Supported Debt Time Trend for the Last Five Years

Adopted Budget (Prior year debt information included here)

Texas Comptroller of Public Debt at a Glance Alief ISD continues to have one of the lowest debt/student ratio and debt per capita ratio in the Region/Area. Please click on the link to view a recent report from the Comptroller on public entity debt.

For more information, refer to the Debt Glossary.

Click on the link to search local government debt data.